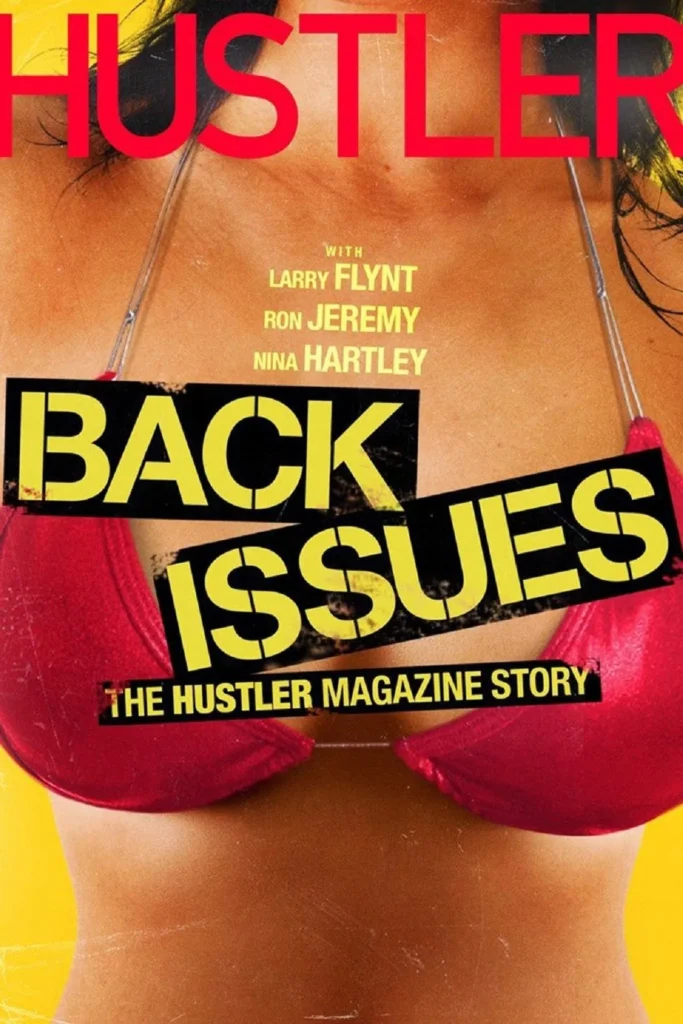

Back Issues is a vivid deep-dive into the rise of Larry Flynt’s infamous Hustler magazine. Made by first-time feature director Michael Lee Nirenberg (son of Hustler art director Bill Nirenberg), the film was conceived as an insider history. Nirenberg explicitly crafted the doc around his father’s 1970s–80s tenure at Hustler. In fact, the film premiered at San Francisco’s DocFest in 2014, where SF Chronicle/SFGate noted Nirenberg is “the son of a former Larry Flynt confidant and creative director for the magazine during the freewheeling ’70s”. That pedigree gives Back Issues a built-in authenticity: this is literally a family chronicle of Hustler.

Story & Structure

The documentary unfolds largely chronologically. It opens on Hustler’s humble origins – a Cincinnati strip-club newsletter – and follows its transformation into a national pornographic powerhouse. Using animated “magazine pages” and tons of Hustler cover art, the film marks key milestones. We see Hustler’s outrageous stunts (the infamous “Meat Grinder” cover, the nude Jackie Kennedy photos and other tabloid gambits) as Larry Flynt himself narrates the rise to fame. Along the way the film covers Larry’s personal rollercoaster: a sudden “born-again Christian” phase and, most famously, the 1978 assassination attempt that left Flynt paralyzed. Finally the doc jumps to modern times, showing Hustler’s attempts to survive in the digital age.

The pacing is brisk – nearly every era of Hustler’s 40-year run gets a taste. Key topics include: Hustler’s start in Ohio clubs; its era of legal battles and First Amendment crusades; and its eventual adaptation to online porn. One reviewer quipped it feels like Hustler’s entire story crammed into 90 minutes, which sometimes makes the narrative feel fragmented. In practice you get a montage of personal stories and archival footage rather than a single through-line. For example, aside from telling the basic Hustler origin tale, the film zips through Flynt’s headline-grabbing court fights and even mentions his late-career presidential campaign.

Topics covered (from archival covers and interviews):

Hustler’s birth as a tiny club newsletter, then its explosive 1970s growth.

Its notorious “Think Pink” campaigns and public stunts (early anti-smoke/anti-drunk ads, risqué photoshoots).

Larry Flynt’s personal saga: his briefly devout phase and the near-fatal 1978 shooting.

Hustler’s high-profile legal battles over obscenity and free speech (implied throughout the interviews).

The decline of print and Hustler’s pivot toward digital distribution by the 2000s.

Key Real-Life Figures

At the heart is Larry Flynt, whose own narration (and rare on-camera interviews) drive the story. Flynt – the self-styled “King of Sleaze” – reflects on Hustler’s wild years. We see him candidly recounting court cases and assassination attempts. His brother Jimmy Flynt also appears (showing Hustler was truly a family affair). Other familiar figures from Hustler’s world pop up: rival porn magnate Al Goldstein (of Screw magazine) offers scathing color commentary, and longtime Hustler attorney Paul Cambria provides a legal perspective.

The documentary features many personalities behind the scenes. Veteran cartoonist Kenneth DeMartines explains how Hustler’s iconic cartoons were created. Underground comedy legend Paul Krassner (a Hustler contributor) shares insider anecdotes. Adult-film stars Ron Jeremy and Nina Hartley – who modeled for the magazine – recount their Hustler-era experiences. Notably, even Hustler’s most notorious figure appears: the film interviews Larry Flynt’s would-be assassin, Joseph Paul Franklin (Herald Price Fahringer), in prison, underscoring the magazine’s real-world impact. In short, Back Issues assembles everyone from Flynt’s team to his rivals (and victims), creating what one writer called “a revealing portrait of a moment in time”.

Archival Footage and Cinematography

Visually, Back Issues leans heavily on Hustler’s own archives. The film is studded with old magazine covers, behind-the-scenes photo shoots, cartoons, and lurid artwork – a feast for nostalgia buffs. As one review notes, “the film’s aesthetic greatly benefits from the decades of content from Hustler, using the covers to mark the passage of time”. These vintage images are edited into dynamic montages underscored by a punk-rock soundtrack, which together “propel the various montages…while underscoring the rebellious and provocative nature of the magazine”. In short, the look is punchy and retro, fitting Hustler’s biker-chic sensibility.

However, the film’s editing has drawn criticism. Because it tries to include so many people and events, the doc often skims rather than delves. Critics say there’s no unifying theme, so it can feel disjointed. Bernard Boo (Way Too Indie) praises the “extensive and often eye-opening” information but warns the “package… is shoddy and rushed”. Tiny Mix Tapes likewise describes it as “informative” but “more like a launching pad for more nuanced material, like a really well done DVD extra”. In practice, Back Issues presents its rich archival footage and candid interviews well (the production values are solid), but it sometimes overwhelms viewers with too many scattered anecdotes.

Reception & Ratings

Critic reviews have been mixed. As of now, Rotten Tomatoes shows only two critic reviews (33% Tomatometer). In the critics’ corner, Boo’s 6.5/10 review found it engaging on info but weak on structure, and Christopher Campbell’s writeup called it “mild, mostly insignificant and fairly deficient” – essentially saying it will only please hardcore Hustler fans. Audience reactions are split: one viewer praised it as “a really engaging look at the creation of the magazine”, while others felt it was simply “okay” or too surface-level.

Across platforms, the ratings tell a similar story of modest enthusiasm:

- IMDb: ~6.5/10 (based on roughly 300 user ratings) – a decent but not stellar score.

- Google Play: 4.1/5 stars from 46 reviewers (indicating generally positive user sentiment).

- Rotten Tomatoes: 33% (Tomatometer; just 2 critic reviews).

- Douban (China): Listed on the site (as “《好色客》背后的故事”), but no user score has been posted yet.

- TMDB/Letterboxd: A few votes/users but no major official rating.

Metacritic and major print outlets did not cover it, reflecting its niche status.

On the audience/popularity side, Back Issues never saw wide theatrical release. It played festivals and then rolled out on digital platforms. It’s currently available on VOD services (Google Play, Amazon, Apple TV etc.), making it fairly accessible to interested viewers. The trailer on YouTube has pulled in hundreds of thousands of views, suggesting reasonable online interest. (By comparison, Hustler founder Flynt’s passing in 2023 did briefly send fans back to Hustler history, but Back Issues remains a specialty title.)

Verdict

In the end, Back Issues: The Hustler Magazine Story is an entertaining inside look at one of publishing’s most controversial empires – exactly the kind of doc that media-history and free-speech buffs will devour. It’s packed with vivid anecdotes, striking archival clips, and colorful personalities. The juiciest parts are real: hearing Larry Flynt and his colleagues actually talk (and even seeing the would-be assassin speak) makes for some eyebrow-raising moments.

However, as a cohesive film it sometimes feels overstuffed. The narrative thread can be loose, and the editing jumps around between subjects. As one critic put it, the film is “informative” but feels more like a DVD extra than a polished feature. Casual viewers without a prior interest in Hustler might find it a bit too scattered.

Who should watch it?

Documentary fans and pop-culture historians will appreciate the trove of Hustler lore. Viewers interested in media history, free speech battles, or the adult publishing industry will get a kick out of this intimate chronicle. Those drawn to Larry Flynt’s legacy (for better or worse) will find plenty of food for thought.

Overall, Back Issues earns a solid 6.5/10. It’s a fascinating behind-the-scenes tale full of spicy details, but its payoff is somewhat diluted by a hectic structure. Die-hard Hustler devotees and lovers of 1970s-80s counterculture will likely rate it higher, while casual doc viewers may find it only mildly engaging.

Rating: 6.5/10